Day Trading vs. Swing Trading What's the Difference? Stockxpo Grow more with Investors

Technology marketed as "low-latency" or "ultra low-latency" is what enables high-frequency traders to place their orders at unfathomably fast speeds. Co-Location: In a largely digital world, sometimes physical proximity still matters. To reduce latency and to drive down the time it takes to execute a trade — even by milliseconds — high.

How to low latency, highfrequency trading_ BSO

(1).webp)

The ability to trade at low latency allows high-frequency traders to profit from the trading environment itself. High-frequency traders exhibit variability in their trading strategies by documenting differences in liquidity provision, end-of-day and maximum intraday positions, and trading revenues, for example, Benos and Sagade . The algorithms.

Low Latency Wireless Networks for High Frequency Trading Gigabit Wireless

Achieving high throughput in the Cloud. Throughput is often a competing concern to latency. In other words, throughput can typically be increased at the expense of latency (by using pipelines.

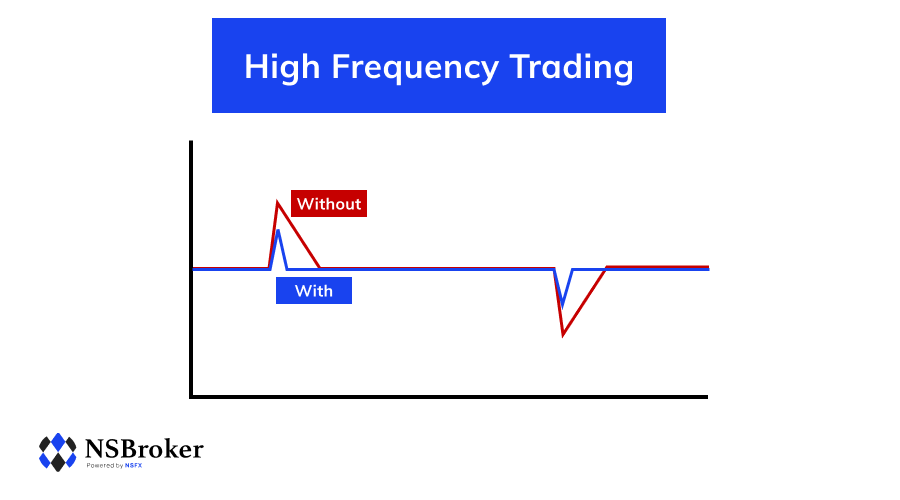

High Frequency Trading NSBroker

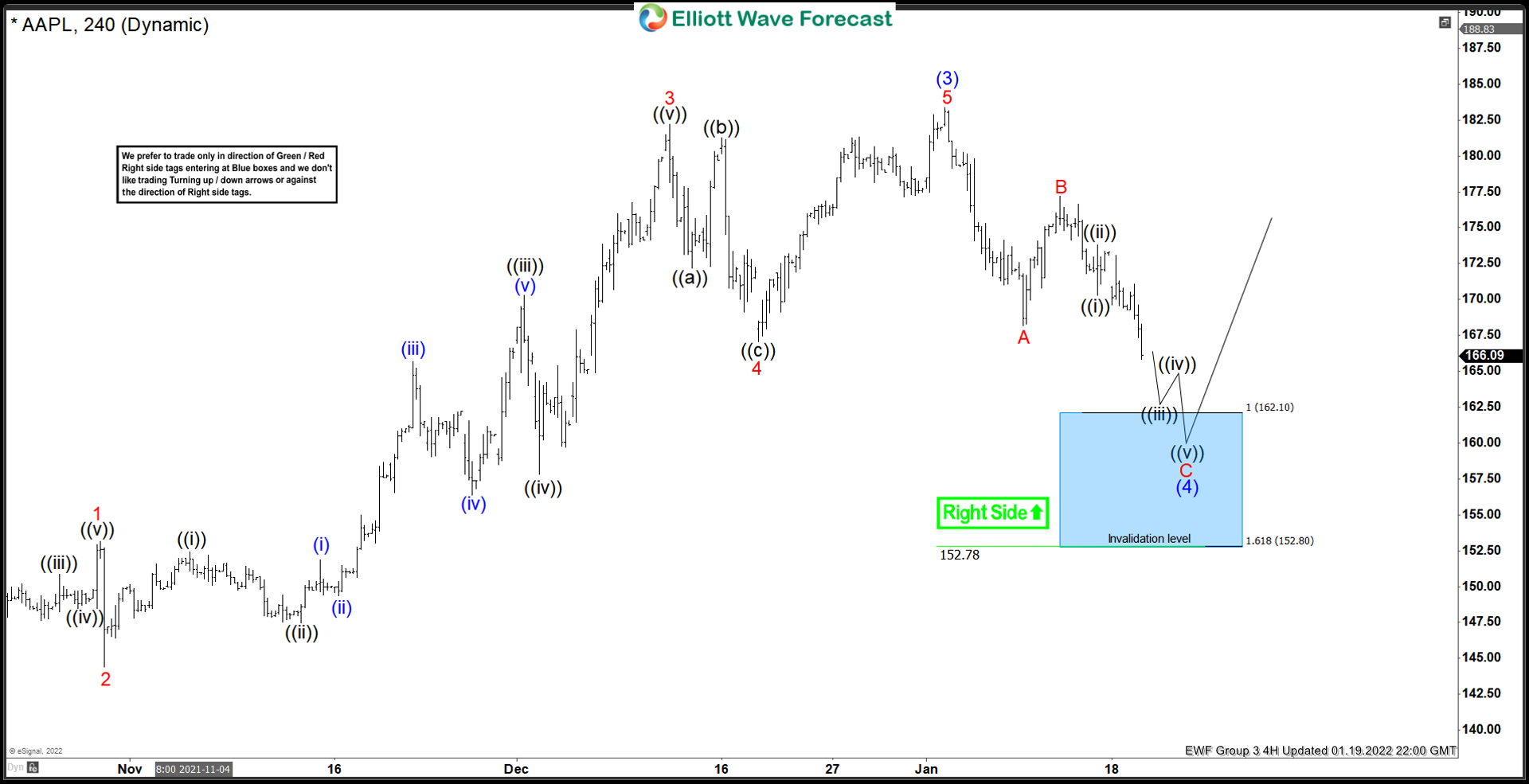

C++ design patterns for low-latency applications A Preprint tency reduction on trading profitability and risk. Section 7 concludes this work and highlights potential future directions. 1.4 Contributions This work offers both academic and practical contributions to the fields of low-latency programming and high-frequency trading (HFT).

¿Qué es el High Frequency Trading (HFT)? Rankia

High-frequency traders (HFTs) account for a considerable component of equity trading but we know little about the source of their trading profits and to what extend IT based differentiators such as news processing power and ultra-low latency has contributed to competitive advantage within HFT realm. Given a fairly modest amount of empirical evidence on the subject, we study the effects of.

Maximizing Security in Low Latency High Frequency Trading Architecture YouTube

High-Frequency Trading - HFT: High-frequency trading (HFT) is a program trading platform that uses powerful computers to transact a large number of orders at very fast speeds. It uses complex.

What is High Frequency Trading? HFT Simply Explained

Low-Latency Strategies. Low-latency strategies rely primarily on ultra-fast speed. The technology takes advantage of the smallest price differences in a given security — as it trades in different markets.. High-Frequency Trading vs. Algorithmic Trading. It's easy to think high-frequency trading and algorithmic trading are the same. They.

High Frequency Trading Explained Business Case Study YouTube

The term high frequency trading has been used quite often recently to refer to trading using real-time tick data (or data aggregated to few seconds) and having an intra-day holding period.. A medium to low frequency trading strategy would be one with low latency (14.8 milliseconds) but a fewer number of intra-day trades (300 vs. thousands.

High Frequency Trading Strategy for MT4 Free Best Forex Trading HFT Scalping System For Big

The key things firms are looking to achieve when seeking to operate a high-frequency trading approach include: High-speed data centers. Real-time data feeds. Advanced algorithms that can rapidly analyse market data. Low-latency network connectivity. Colocation - placing HFT servers closer to the exchange servers.

Two Technology Trends in HighFrequency Trading Tech Invest

Abstract We define low-latency activity as strategies that respond to market events in the millisecond environment, the hallmark of proprietary trading by high-frequency traders though it could include other algorithmic activity as well. We propose a new measure of low-latency activity to investigate the impact of high- frequency trading on.

What Is HighFrequency Trading (HFT)? How It Works and Example

:max_bytes(150000):strip_icc()/high-frequency-trading.asp-final-88956b5664b34a51936e613a61219b25.png)

Low Latency Trading is the linchpin of High-Frequency Trading, where fractions of a second can make or break a trade. The minimization of time delays between order initiation and execution is pivotal for HFT success. By understanding the critical concepts, including the ten factors that shape its functionality, traders can navigate the fast.

How does latency impact highfrequency trading strategies? WalletInvestor Magazin Investing news

High Frequency Trading is mainly a game of latency (Tick-To-Trade), which basically means how fast does your strategy respond to the incoming market data. The "Bleeding edge" firm actually talks of single-digit microsecond or even sub-microsecond level latency (Ultra High Frequency Trading) with newer, sophisticated and customized hardware.

High Frequency Trading (HFT) Explained High Frequency Trading in Hindi YouTube

This essay examines three potential arguments against high-frequency trading and offers a qualified critique of the practice. In concrete terms, it examines a variant of high-frequency trading that is all about speed—low-latency trading—in light of moral issues surrounding arbitrage, information asymmetries, and systemic risk. The essay focuses on low-latency trading and the role of speed.

Developing HighFrequency Trading Systems Learn how to implement highfrequency trading from

In Pursuit of Ultra-Low Latency: FPGA in High-Frequency Trading. High-frequency trading (HFT) has received a lot of attention during the past couple of years, turning into an increasingly important component of financial markets. HFT is all about the speed: the faster your computer algorithms can analyze stock exchanges and execute trade orders.

In Pursuit of UltraLow Latency FPGA in HighFrequency Trading Velvetech

Nowadays, low-latency is achieved with co-location, low-latency wireless networking between trading venues, high-performance networking, FPGA, and compute technology. Using an overclocked server.

Ultra Low Latency Technology in the Trading Industry Resource

Latency has been a hot topic in financial markets since the rise of high-frequency trading in the early 2000s. Low latency has been replaced with ultra-low latency (ULL) in liquid markets as technology has slashed tick-to-trade latencies below one microsecond. While many vendors outline how their products contribute to a faster trade.